Hey Anika,

I’ve been a regular reader of your financial wisdom on Revyo, and let me tell you, your articles are a breath of fresh air! I can finally understand all these financial jargons people throw around.

So here’s my story: I’m Carla, a 65-year-old art teacher who just hung up her brushes and retired last month. My journey was a bit unconventional. I worked a corporate job in my 20s and 30s before taking a leap of faith to follow my passion for painting. I’ve been teaching art in a local community college and selling my artwork for the past 25 years.

I’ve saved a fair amount during my corporate days and was able to add to it a bit while working as an art teacher, but now that I’m retired, I’m feeling a bit anxious. The question on my mind every day is: “How can I make sure my retirement savings last as long as I do?”

I’m in good health (touch wood), and longevity runs in my family. My grandma lived to be 98, so I need my savings to stretch for possibly 30 years or more. Besides, I have a bucket list of art galleries and cultures I want to explore, which would require some spending, of course!

Carla M

Dear Carla,

Your email brought a big smile to my face! First off, congratulations on your retirement and on having the courage to follow your passion. Not many people get to say they’ve pursued what they love. Your story is inspiring, and I can imagine what a difference you made in the lives of your art students.

Now, let’s dive into how we can help you paint a masterpiece with your retirement funds.

- Create a Budget Canvas: Like sketching before painting, it’s important to have a financial blueprint. Break down your expenses into essentials, leisure, and goals (those art galleries you’re eager to explore). Knowing where your money is going is the first step in making it last.

- Brush Strokes of Diversification: Your investments shouldn’t be retired just because you are! Maintain a diversified portfolio that’s a mix of stocks, bonds, and other assets. You don’t want to be too conservative because you need your investments to outpace inflation.

- Social Security Palette: Optimize your Social Security benefits. Sometimes it’s worth delaying until you’re 70 if you’re in good health and have a family history of longevity (shout-out to your grandma!).

- Medicare and Health Care Hues: Make sure you’re signed up for Medicare and consider a supplemental policy. Health care costs can be like abstract art—confusing and expensive. Being prepared can prevent a significant drain on your savings.

- Part-Time Passion Income: You mentioned you’re an art teacher. How about hosting art workshops or classes occasionally? This could provide some extra income and keep you engaged in your passion.

- Travel Paints: For your travel goals, consider planning them during off-peak seasons. You’ll save money, and the galleries will be less crowded!

- Embrace the Thrift Store Style: As an artist, you can appreciate the beauty in the old and reused. Be frugal where it counts. Shop smart for your everyday needs so you can splurge on the things that truly matter.

- Emergency Savings Sketchbook: Keep an emergency fund so that an unexpected expense doesn’t throw a wrench in your master plan.

Remember, retirement is just the beginning of a new chapter. Keep your creative juices flowing, stay social, and engage with the world through your art. You’ve got a beautiful, colorful journey ahead, and your well-managed retirement savings can be the brush that paints it.

If you ever have any artwork inspired by your travels, I’d love to see it!

Wishing you a vibrant and fulfilling retirement, Carla.

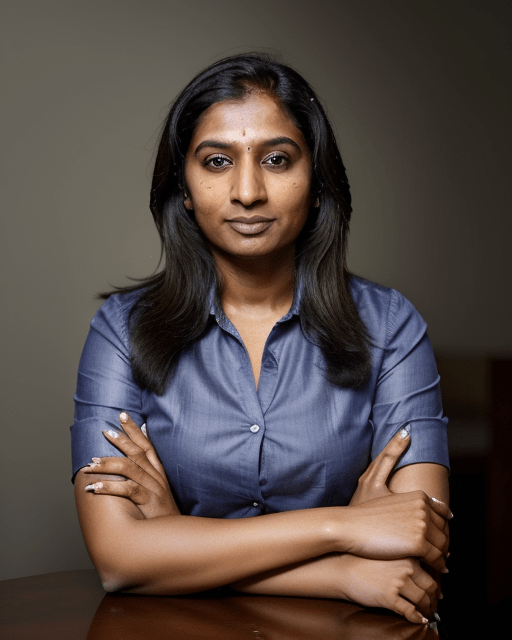

Colorfully Yours, Anika Patel