Dear Anika,

I am an ardent follower of your finance articles on Revyo, and I’ve found your advice to be incredibly practical and insightful. You have a knack for breaking down complex financial concepts into understandable, actionable steps, which I greatly appreciate.

I’m a 40-year-old professional working in the non-profit sector and earn around $70,000 annually. I’ve been contributing to my 401(k) plan, but honestly, I started later than I should have – only about 10 years ago. I currently have about $80,000 saved for retirement, but I’m anxious that it might not be enough.

Your recent article on retirement income got me thinking, how much should I have saved for my retirement at this point in my life? I know there are standard benchmarks like having 2-3 times your salary saved by 40, but does this apply to everyone universally?

I’m single with no children, and my lifestyle is fairly low-key. I don’t have any grand plans for traveling the world in my retirement, but I would like to live comfortably without financial worry, maintain my current lifestyle, and have the ability to cover unexpected expenses, especially related to healthcare.

Any advice you can provide on how much I should aim to have saved by retirement would be deeply appreciated. Thank you in advance!

Samantha C.

Dear Samantha,

Thank you for your kind words about my articles and for reaching out with your question. It’s a very common concern, and you’re not alone in wondering about it.

As you mentioned, there are various benchmarks suggested by financial experts, like having 2-3 times your annual income saved by age 40. While these can be helpful as a general guide, they might not accurately reflect everyone’s individual circumstances.

You’ve noted that you lead a fairly low-key lifestyle, and you don’t foresee your lifestyle changing significantly during retirement. This information, along with your current income and savings, is a great starting point for estimating how much you should save.

A commonly used strategy is the ’25 Times Rule’, which suggests that you should aim to have 25 times your annual expenses saved by the time you retire. This rule is based on the ‘4% Rule’ of retirement, which assumes that you’ll withdraw 4% of your retirement savings in the first year of retirement and adjust this amount for inflation in subsequent years.

Given that you aim to maintain your current lifestyle in retirement, you’ll first want to have a clear understanding of your current annual expenses. This will help you estimate the annual expenses you’re likely to incur during retirement, which can then be multiplied by 25 to give you a rough estimate of your retirement savings goal.

For example, if your annual expenses are $50,000, you should aim to save about $1.25 million ($50,000 * 25) for retirement.

Remember, though, that this is a simplified scenario. Other factors such as potential medical expenses, inflation, and changes in your lifestyle should be considered. Furthermore, the ‘4% Rule’ may not be suitable for everyone, especially given current low-interest rates and longer lifespans.

Given the nuances and complexities involved in retirement planning, I strongly recommend consulting with a financial advisor. They can help you create a more detailed and personalized retirement savings plan, taking into account your unique situation and future goals.

I hope this gives you a helpful starting point for your retirement planning. Remember, it’s never too late to start or refine your strategy. Every step you take towards your retirement goals now will make a significant difference in the future.

Best Regards,

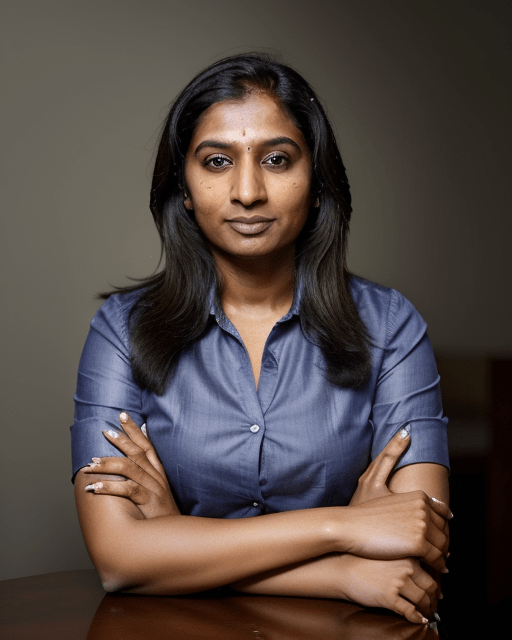

Anika Patel

1 thought on “How Much Should I Have Saved for Retirement?”

Comments are closed.