In the digital age, social media has transformed into more than just a space for connecting with friends and sharing life updates; it has evolved into a crucial resource for financial advice and literacy. A recent study dives into the heart of this transformation, focusing on Reddit’s personal finance subreddit, a vibrant community where users from various backgrounds gather to seek and share financial wisdom. This exploration sheds light on how individuals navigate financial challenges and opportunities through collective knowledge and artificial intelligence (AI) assistance.

The study meticulously analyzes the interactions within this subreddit, employing sophisticated techniques to sift through vast amounts of data, identifying patterns, trends, and the nature of queries and advice shared among users. It stands out by not just examining the content but also understanding the nuances of user engagement and the role of AI in shaping financial discussions.

Findings and Insights:

The study’s deep dive into Reddit’s personal finance discussions unveiled a treasure trove of insights on how people seek financial advice and the collective wisdom shared within the community. Here are some key findings:

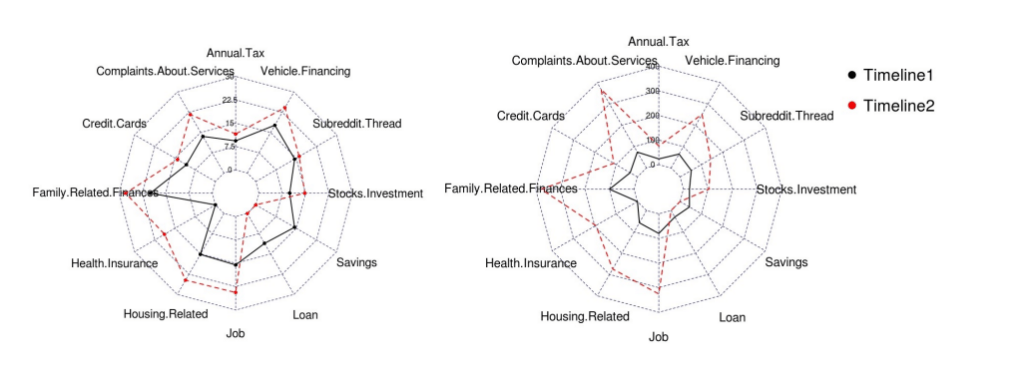

- Diverse Financial Topics: Analysis revealed a wide range of financial topics, from the basics of budgeting and saving to the complexities of investing and navigating debts. This diversity reflects the subreddit’s role as a comprehensive resource for financial information, catering to users at different stages of their financial journey.

- Emerging Financial Concerns: The study highlighted the dynamic nature of financial discourse on Reddit, with emerging topics such as cryptocurrency and fintech innovations gaining traction. These discussions not only provide insights into the latest trends but also underscore the community’s role in demystifying new financial territories.

- The Power of Community Engagement: The research emphasized the significance of community engagement in enhancing financial literacy. Through upvotes, comments, and shared experiences, users contribute to a collective knowledge base that offers support, advice, and different perspectives on managing finances.

- AI’s Role in Financial Discussions: The study also explored the contribution of AI technologies, like ChatGPT and Vicuna, in responding to financial queries on Reddit. It compared AI-generated advice with human responses, offering fascinating insights into the potential of AI to complement human wisdom in financial discussions.

- Implications for Financial Literacy and Education: The findings underscore the importance of social media platforms like Reddit in promoting financial literacy. By providing a space for open dialogue and shared learning, these platforms are pivotal in empowering individuals with the knowledge and confidence to make informed financial decisions.

Implications for Financial Advisors and Educators

The intricate dance between human insight and AI in financial discussions on Reddit not only changes the landscape of personal finance but also holds profound implications for financial advisors and educators. As we venture further into the digital age, the role of these professionals is increasingly pivotal in guiding individuals through the complex world of finance with a blend of traditional expertise and technological savvy.

- Bridging the Digital Divide: Financial advisors and educators can leverage insights from social media discussions to understand the evolving financial interests and concerns of the public. This knowledge can inform the development of more relevant and engaging educational materials and advice.

- Enhancing Personalized Advice with AI: The integration of AI in financial discussions exemplifies the potential of technology to personalize and scale financial advice. Advisors can incorporate AI tools to provide timely, tailored advice to a broader audience, complementing their expertise with algorithmic analysis.

- Fostering Financial Literacy Through Community Engagement: The study underscores the importance of community in financial education. Advisors and educators can create or participate in online forums to directly engage with individuals seeking financial guidance, providing a human touch to the digital exchange of knowledge.

- Adapting to New Financial Trends: The emergence of topics like cryptocurrency in online discussions signals shifting financial landscapes. Advisors and educators must stay abreast of these trends, incorporating new knowledge into their practices to remain relevant and effective.

The illustration accompanying this section captures the essence of community, technology, and financial literacy coming together in the digital realm. It visually represents the diverse discussions and contributions that make platforms like Reddit’s personal finance subreddit a dynamic resource for financial learning and sharing.

The study not only illuminates the significant role of social media in financial literacy but also highlights the transformative potential of integrating human wisdom with technological advancements. For financial advisors, educators, and individuals alike, the findings offer a roadmap for navigating the complexities of personal finance in a connected world, empowering us all to make more informed financial decisions.